What does it matter that it is super easy to shop online if the logistics and transport management is for the birds? In 2011, Alibaba’s Jack Ma decided to try to tackle something Amazon’s Jeff Bezos has not been able to do: crack the logistics code. The result of his endeavor is Cainiao, which is definitely a feather in Jack Ma’s cap.

“But wait a minute,” you might say, “is Amazon not the best in the world when it comes to logistics and deliveries?” Maybe. The question is not really “relevant.” Because the ways Amazon impresses us do not represent a sustainable strategy in the long run—unless you want a future where all the kinds of retailing in the world have become part of Amazon. And somewhere in this lies the DNA strand that makes Jack Ma Jeff Bezos’ superior.

First, two clarifications.

1. Alibaba “Is” Platforms—Not a Brand Eliminator

Amazon is fundamentally a retailer whose most important brand is Amazon.

Alibaba Group, however, offers (among other things) e-commerce platforms throughout different business segments (B2B, B2C, C2C), and calls itself a data company. Both collect customer data, but Alibaba “shares” the data with those who sell via its platforms. Alibaba’s business model has created a symbiotic incitement structure: the better the individual brands do, the better Alibaba does. Amazon keeps its data to itself, since it does not compete with third-party sellers on its own platform.

2. Alibaba Does Not Want to Own Transports or Offer Fulfillment Services

JD.com is a Chinese company that is comparable to Amazon. This e-commerce actor is similar to the American giant online retailer, at least from a logistics perspective. Much like Amazon, JD.com has a vertically integrated direct logistics model: The company “owns” or controls (as much as possible) the whole delivery chain. This gives the company power but also makes it asset heavy, or “tail-heavy,” to speak Alibaban. JD.com employs approximately 65,000 last-mile delivery messengers, for example.

Up until 2011, logistics were a non-issue for Alibaba, since it did not want to own anything except data.

Read more: E-commerce Lattes—LogTrade in China

Okay, What Did Jack Ma Do in 2011?

Eight years ago, Jack Ma said something like this: “The whole logistics and transportation industry has to find some way of cooperating or it does not matter how many orders are placed on our own, or other, platforms. Our customers will not be able to reach new customers in remote rural areas, either, if they have to rely on a poorly functioning and undigitized transport or warehouse management market.”

What he meant was that if “variables” such as sorting, packing, loading, logistics management, line hauling, cross-docking, and last-mile deliveries are not...

… a. Available everywhere

… b. Connected to each other and everyone else,

then every manufacturer and retailer must either try to look out for themselves in an Amazon-like way, for example by buying their own delivery trucks or hiring their own delivery messengers, which is very cost intensive, or they will have to try to make use of the existing warehousing and delivery services as best they can.

The whole logistics and transportation industry has to find some way of cooperating or it does not matter how many orders are placed on our own, or other, platforms.

The principle of the logistical dilemma is similar in every country. The reason is, among others, that there has not been a standardized language for logistics. That is why we are in a situation today where the question of whether or not Amazon is going to launch in Sweden generates a plethora of articles debating whether or not to join, or how integrated with Amazon companies should be, or whether daring not to board the train at all is the best idea.

Download: Amazon for Dummies

What Jack Ma started to busy himself with in 2011 was to give China, and the world, a logistics reality that makes Amazon a non-issue, or at least not the only option.

Amazon has, of course, never really caused that much of a headache for the Chinese e-commerce market. Instead, the matter of logistics has provided bigger challenges on a more fundamental level. There has not been a UPS or FedEx in China, for example, meaning there are no carriers that can deliver to any address, anywhere in the country. This is also one of the contributing factors regarding why Alibaba chose to take full responsibility for logistics ,and in a big way. It is also likely to be in line with what the Chinese government wants.

One strong contributing factor to Alibaba’s logistical ambitions has been Singles Day 11.11, China’s (many times larger) equivalent to Black Friday and Cyber Monday.

Read more: In China, People Do Not Think About Amazon

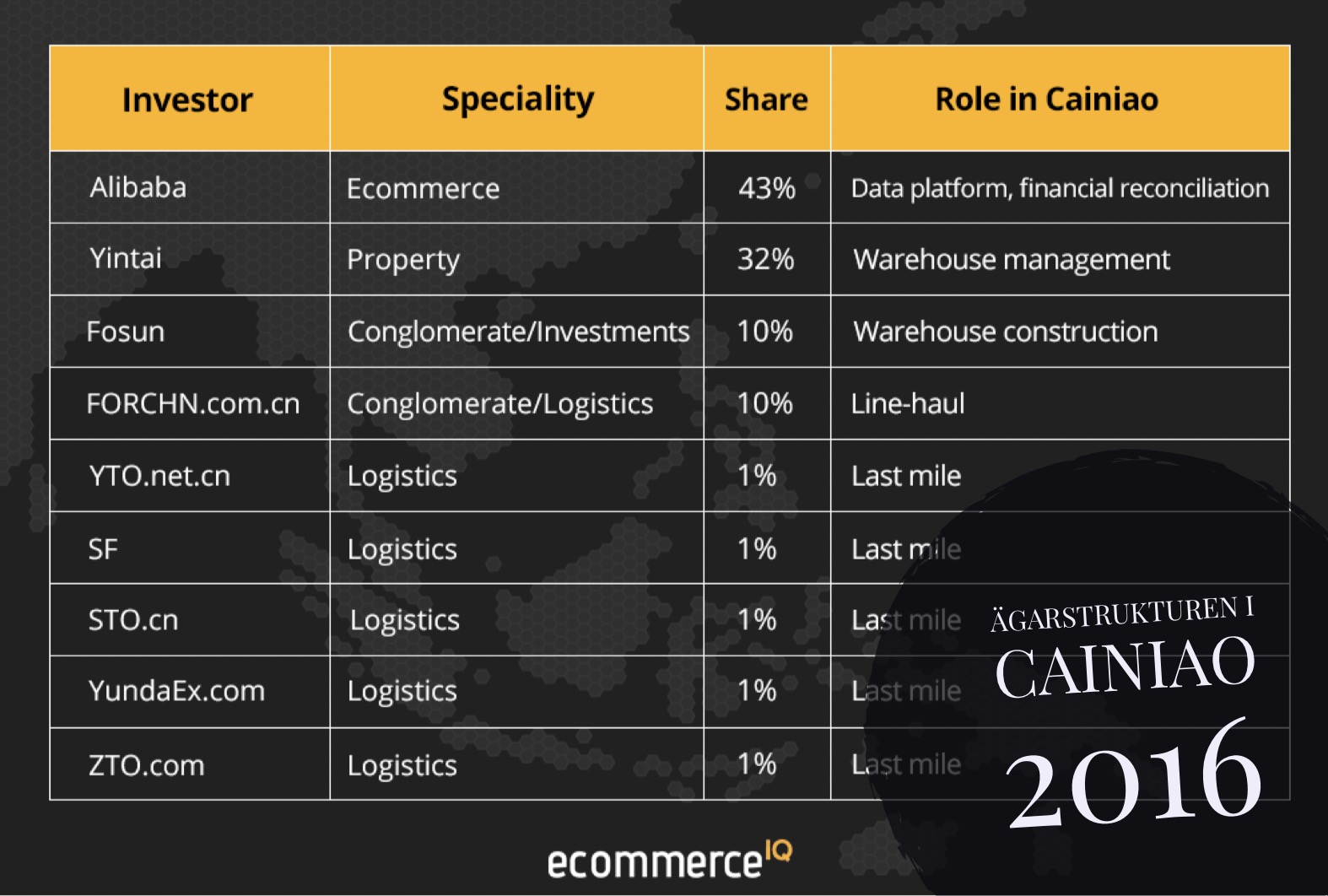

That is why—two years later—Alibaba, together with eight other companies and conglomerates in shipping, real-estate, and construction, started Cainiao. This is what the ownership structure looked like then. Since 2017, Alibaba has owned 51 percent.

Source: e-commerce

What is Cainiao?

Cainiao is a smart, open, and decentralized logistics network. It is a national, global, and horizontal big-data platform open to all carriers and logistics companies. And yes, that includes JD.com and Amazon should they one day decide they want to join. Cainiao is built on the idea that everything as a whole is bigger than the individual parts if everyone makes their services available on a platform that aims to be neutral.

The quote-making machine Jack Ma describes the essence of Cainiao like this:

If we can use data to solve the problem of low transport efficiency and high logistics costs, we can create huge profit margins for the manufacturing industry and logistics sector: I think this is what Cainiao and our logistics industry should do for the country.

And like this:

This network is not only national but global: We want to connect every courier, every warehouse, every hub, every city, and every house.

What Use Is Cainiao to the Mere Mortal?

You know those apps that carriers provide so you can track your package? Imagine if you only needed one single app to track all your shipments—regardless of whoever in the world is bringing it to you? Cainiao can offer this today. The app is called Guoguo (菜鸟裹裹), and by using it you can track any package that is shipped via Cainiao’s network.

Another example is delivery hubs. Cainiao has made it possible for people to pick up their packages at a variety of locations if they choose not to have them delivered to their homes, and is also working on some other cool stuff.

Read more: The Point—A New Swedish Delivery Concept

Cainiao—More Logistics for the Money

Cainiao can also be described as a logistics process whose purpose is to streamline warehouse and delivery processes in China by taking a helicopter perspective, so that logistics can cost 5 percent of the GDP instead of 15 percent. Its purpose is also to globalize e-commerce, making it easy to shop across regional and national borders.

To put it simply, Cainiao has five pillars:

- Express deliveries. Using big data to help carriers work in a more data-driven way. Via Cainiao, carriers receive data feedback that enables them to work smarter. At the same time, all carriers in the system are used in a more collective way that reduces competition between carriers and eliminates price wars: Everything as a whole becomes bigger than each individual part via Cainiao; Delivering a package smartly and efficiently is more important than who delivers it. The express strategy does not mean that carriers are anonymous. Recipients can always review and send feedback to the carrier.

- Warehouse and distribution: Cainiao is in the process of expanding its collaborative network of distribution hubs, which are placed in strategic locations so costs for next-day deliveries can be reduced. And with the help of IoT (Internet of Things) and other related technology, the company is, step-by-step, fully automating warehouse management.

- Cross-border logistics: Cainiao removes the silo structures that isolate carriers in the national arena, and also has the ambition to reduce the friction for package deliveries across country borders. The company has set up warehouses, bought airports, and established connections and agreements with national postal services such as Russian Post, US Postal Services, and many more.

- Urbanization of the countryside. Cainiao’s countryside strategy is best described in this touched-up film clip.

- Pick-up hubs. With the help of partners, Cainiao has built so-called pick-up stations all around China. It has created some kind of crowd-sourced last-mile stations with the help of everyone from student entrepreneurs at various universities to property companies and grocery stores. Any place can be a package pick-up location. In 2018, Cainiao had 28,000 hubs.

Så har Alibaba knäckt den logistiska koden?

Jack Ma brukar säga i intervjuer att man gärna får vara kär i staten men man ska inte gifta sig med den. Svaret är undvikande och avväpnande men givetvis är gränsdragningen för ett mäktigt företag i en repressiv diktatur problematisk. Vilket vi svenska företag ofta förhåller oss lite naiva till.

Och även om Cainiao ser ut att vara en ostoppbar kraft finns det grus i maskineriet, konstigt vore annars: det handlar trots allt om att få så många olika transportörer som möjligt att gå med på nya marknadsvillkor.

Men det ena utesluter inte det andra: Alibaba och Cainiao är värdedrivna kraftmaskiner som jobbar strategiskt, smart och har mycket att lära i en värld som stirrat sig blind på The Big Four, inte vet skillnaden mellan Tencent och Taobao eller tror att Amazon har världens bästa leveranser.

Men har de knäckt koden då?

Det har åtminstone fattat grejen. Eller som Jack Ma så elokvent lägger fram det:

World Trade will change because of logistics. Global trade will go from containers to packages, from trading between countries to trading between companies. All this change, we should be ready to prepare and fight today.

Mic drop ...

All This Talk of About Alibaba and Amazon—Are There no Other Alternatives?

There are several active standardization projects for logistics around the world. The most interesting and ambitious is Ericsson’s Internet of Logistics (IoL) and its cloud-based platform, CLC. IoL is an open and neutral standard that is managed by the IATA (International Air Transport Association).

With the help of IoL, CLC, and LogTrade, you will be able to develop new business ideas and work smarter when it comes to shipping and logistics. All you need to get access to the system is LogTrade’s software for logistics and delivery management. If you are already using LogTrade, getting started will be even easier. Contact us, and we will tell you more.

Facts

CAINIAO’s SMART LOGISTICS NETWORK—IN NUMBERS

- Processes 100 million packages per day.

- Goal: 72 hours globally, 24 hours nationally.

- Has succeeded in reducing the average international delivery time to some countries from 70 days to 10 days.

- 3000+ logistics partners.

- 200+ connected warehouses.

- 3 million+ “connected” express personnel.

- The largest logistics database in the world: Processes up to 9 billion protocols per day. Over 70 percent of all its shipments have had their delivery route optimized by an algorithm.

- The e-shipping label has reached 81 percent market penetration in China.

Source: Unctad.org